what is a bull flag in technical analysis

The pattern is created when the price of a security rises rapidly and then falls. A bull flag is a technical analysis pattern that can identify potential buying opportunities in a market.

The Bull Flag Pattern Trading Strategy

The bull flag should have an uptrend since its a continuation pattern and isnt a reversal.

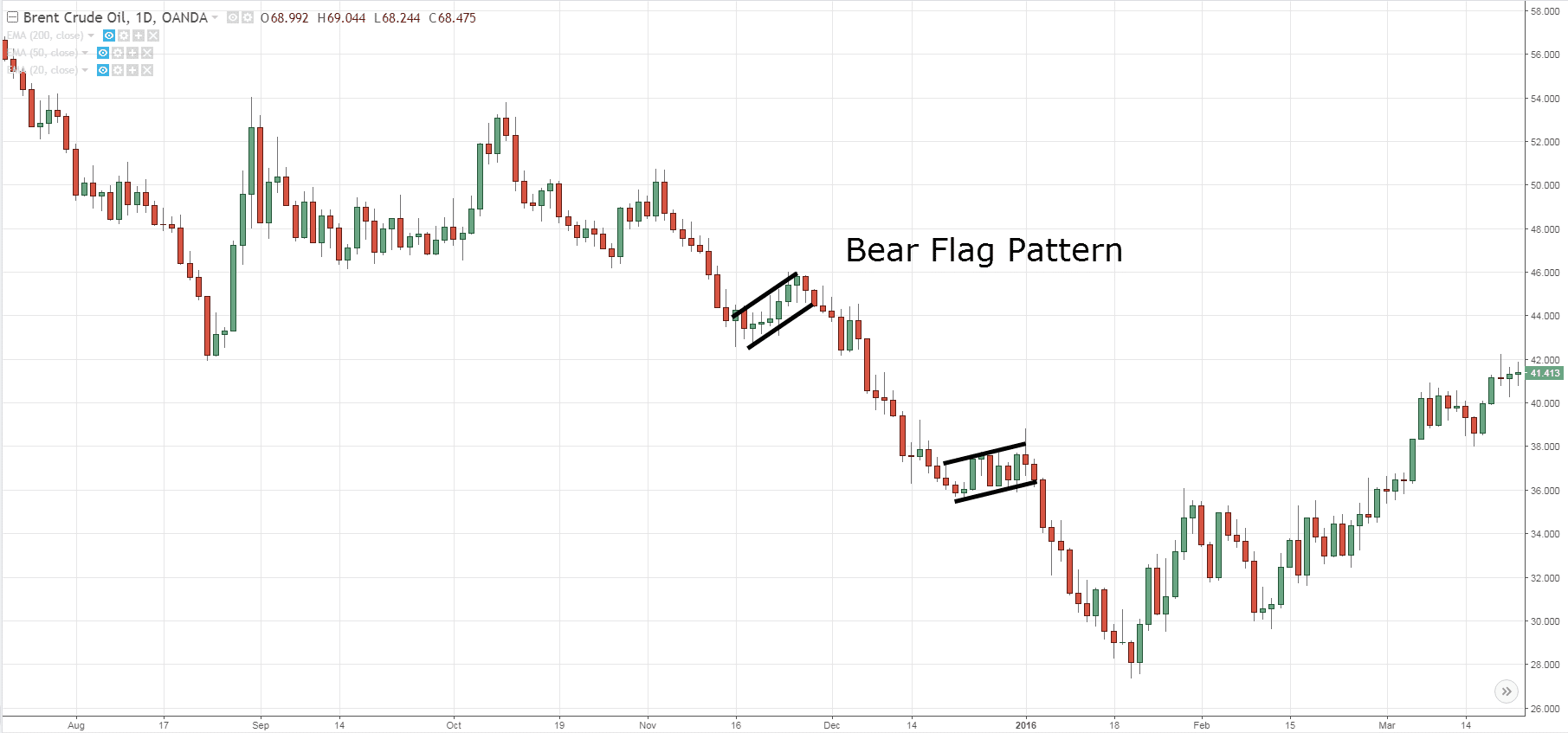

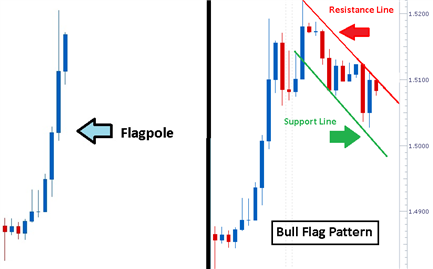

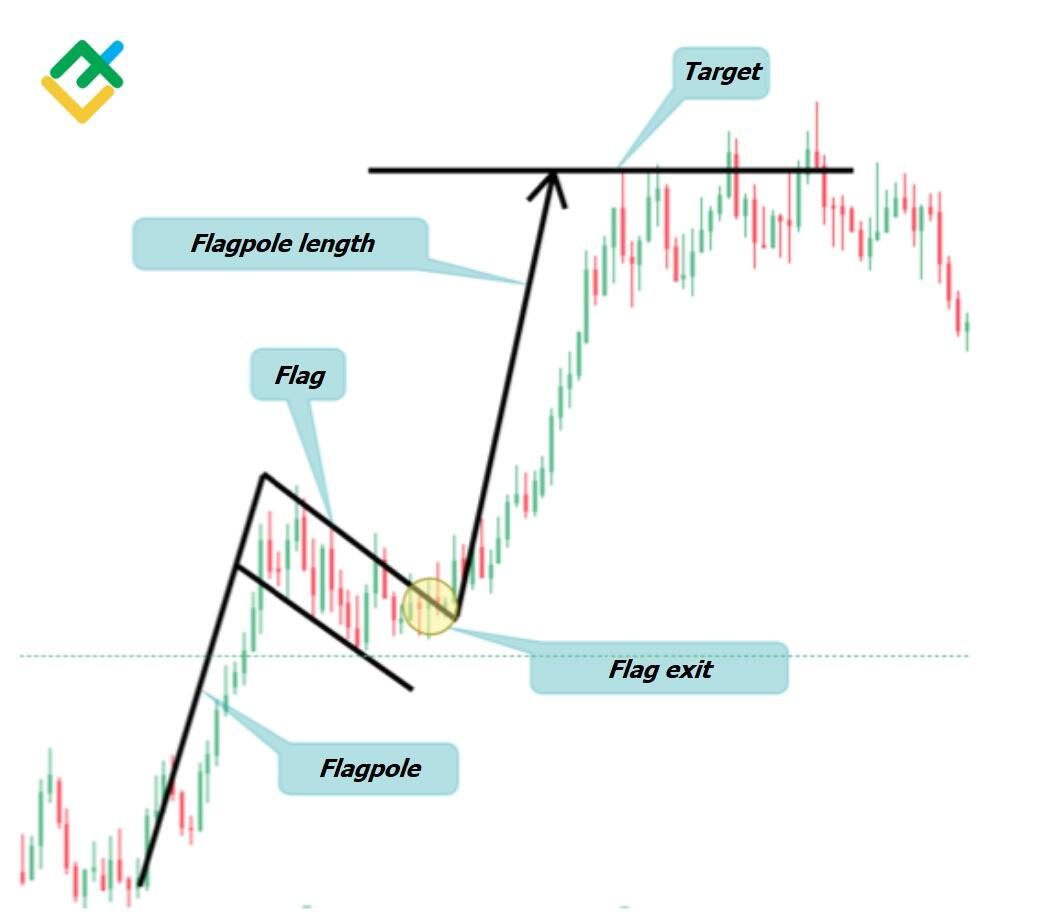

. A flag pattern in technical analysis is a price chart characterized by a sharp countertrend the flag succeeding a short-lived trend the flag pole. It is considered a bullish flag pattern because it generally forms during an uptrend. A bearish flag is the complete opposite of a bullish one it means a trend reversal at the top.

In technical analysis bull and bear flag patterns are well-known and easily recognized price patterns. A bull flag is a technical analysis pattern that can identify potential buying opportunities in a market. TechnicalAnalysisPakistanStockMarketMyIdeasTradingTechnical Analysis of a particular Stock is very essential prior to investing in Pakistan Stock Exchange.

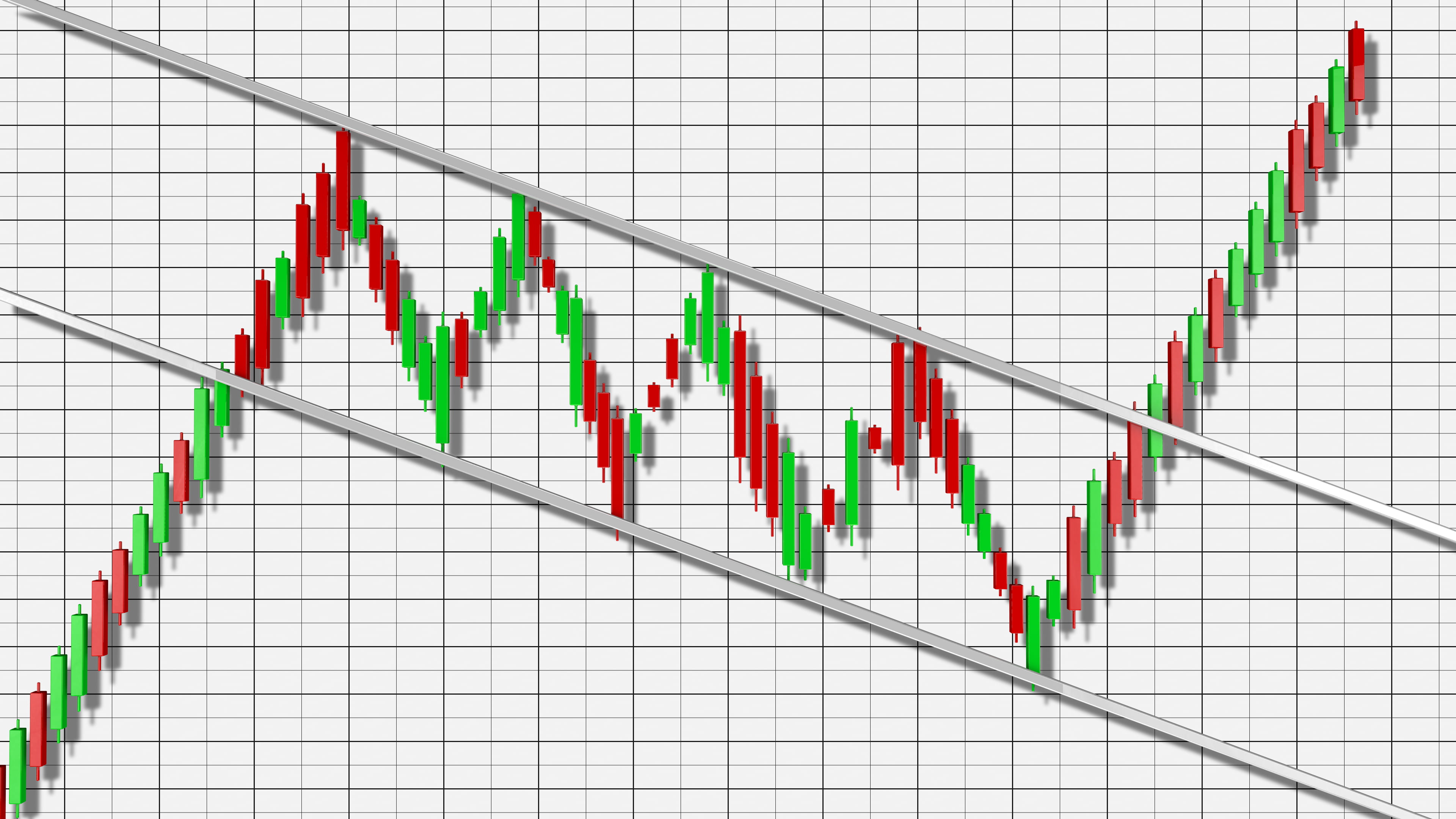

It occurs when a stock or other security trades in a sideways range after. A bull flag pattern is a technical analysis term that resembles a flag. Traded properly it can be among the more reliable.

When the price of a stock or asset swings in the opposite direction. You may say its a bull. When trading a bull flag traders might use a.

A technical analysis pattern called the bull flag is a recognized price pattern and is thought to indicate that a price increase is about to occur. This pattern is a bullish continuation. A bull flag chart pattern is a technical analysis tool to identify periods of increased stock prices.

A bull flag is a widely used chart pattern that provides traders with a buy signal indicating the probable resumption of an existing uptrend. What is a bear flag pattern. Bull and bear flags are both strong continuation patterns.

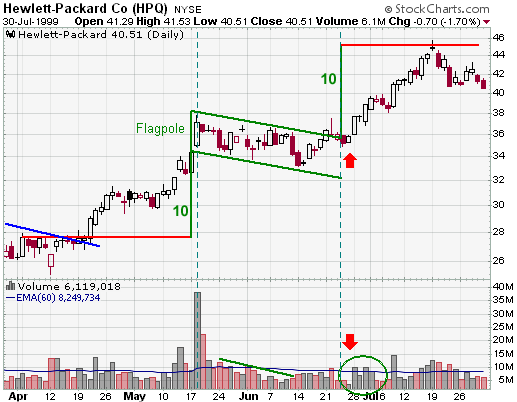

The height of the flagpole projected from the breakout level will arrive at a proportionate target. A bull flag is a chart pattern often used in technical analysis and trading to identify a bullish continuation. This article will discuss what a bull.

A bull flag pattern is a sharp strong volume rally of an asset or stock that portrays a positive development. The bull flag pattern is a great pattern to add to a forex traders technical arsenal. The bull flag pattern is a continuation pattern.

The pattern is easy. Flag and Pennant Chart Patterns in Technical Analysis. When the correction begins and the price drops.

Explosive moves are often associated with the bull flag. A bull flag is a widely used. The better-performing flags are ones where there is a strong flagpole and the flag is in a tight formation.

Bull flag vs Bear flag. It usually occurs after a sustained downtrend and it is marked by a. Bull flag and bear flag patterns summed up.

Bull Flags And Pennants Definition Chartmill Com

Learn Forex Trading The Bull Flag Pattern

Bull Flag Vs Bear Flag Predict Short Term Trends Phemex Academy

How To Trade Bull And Bear Flag Patterns Ig Us

Arps Flag Patterns Financial Market Trading Indicators Technical Analysis Programming

Bull Flag And Bear Flag Chart Patterns Explained

Bullish And Bearish Flag Patterns Stock Charts

Learn Forex Learn How To Trade The 1 Chart Pattern The Bull Flag

Bull Flag And Bear Flag Chart Patterns Explained

What Is The Pole And Flag Pattern In The Technical Analysis Of The Stock Market Quora

Flag Patterns Bullish And Bearish Accendo Markets

Bearish Flag Chart Patterns Education Tradingview

Bull Flag Chart Pattern Trading Strategies Warrior Trading

How To Trade Bullish Flag Patterns

:max_bytes(150000):strip_icc()/Clipboard01-a46e5a7d83b34cf29a56ee9b4f10d0ad.jpg)

Bullish Flag Formation Signaling A Move Higher

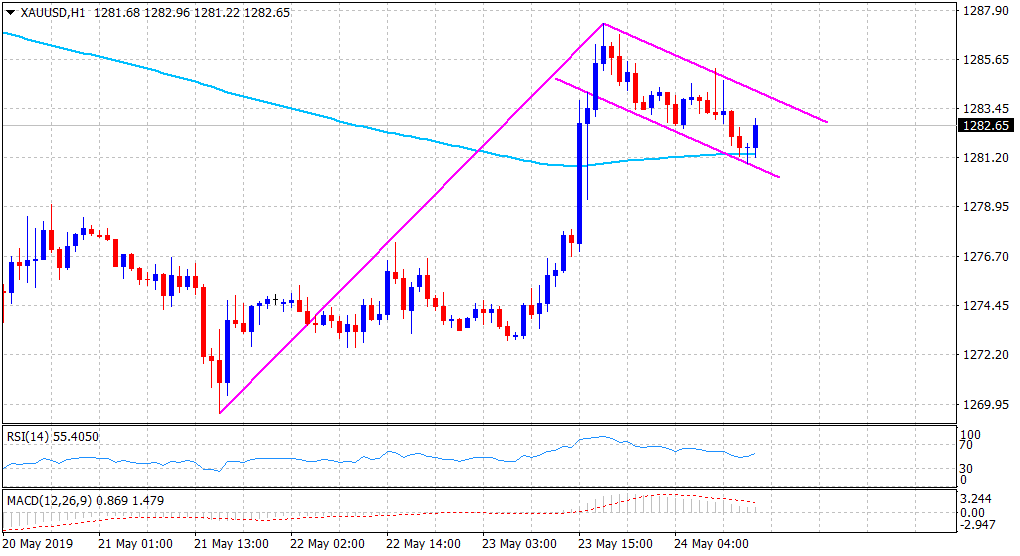

Gold Technical Analysis Bullish Flag Pattern Spotted On 1 Hourly Chart

-636831276454424185.png)

Eur Usd Technical Analysis Euro Has Charted A Bull Flag

What Is Bull Flag Pattern And How To Use It In Trading Litefinance